What Is a Money Market Fund ?

A money market fund is a kind of mutual fund that invests in highly liquid, near-term instruments. These instruments include cash, cash equivalent securities, and high-credit-rating, debt-based securities with a short-term maturity (such as U.S. Treasuries). Money market funds are intended to offer investors high liquidity with a very low level of risk. Money market funds are also called money market mutual funds.

While they sound similar in name, a money market fund is not the same as a money market account (MMA). A money market fund is an investment that is sponsored by an investment fund company. Therefore, it carries no guarantee of principal. A money market account is a type of interest-earning savings account. Money market accounts are offered by financial institutions. They are insured by the Federal Deposit Insurance Corporation (FDIC), and they typically have limited transaction privileges.

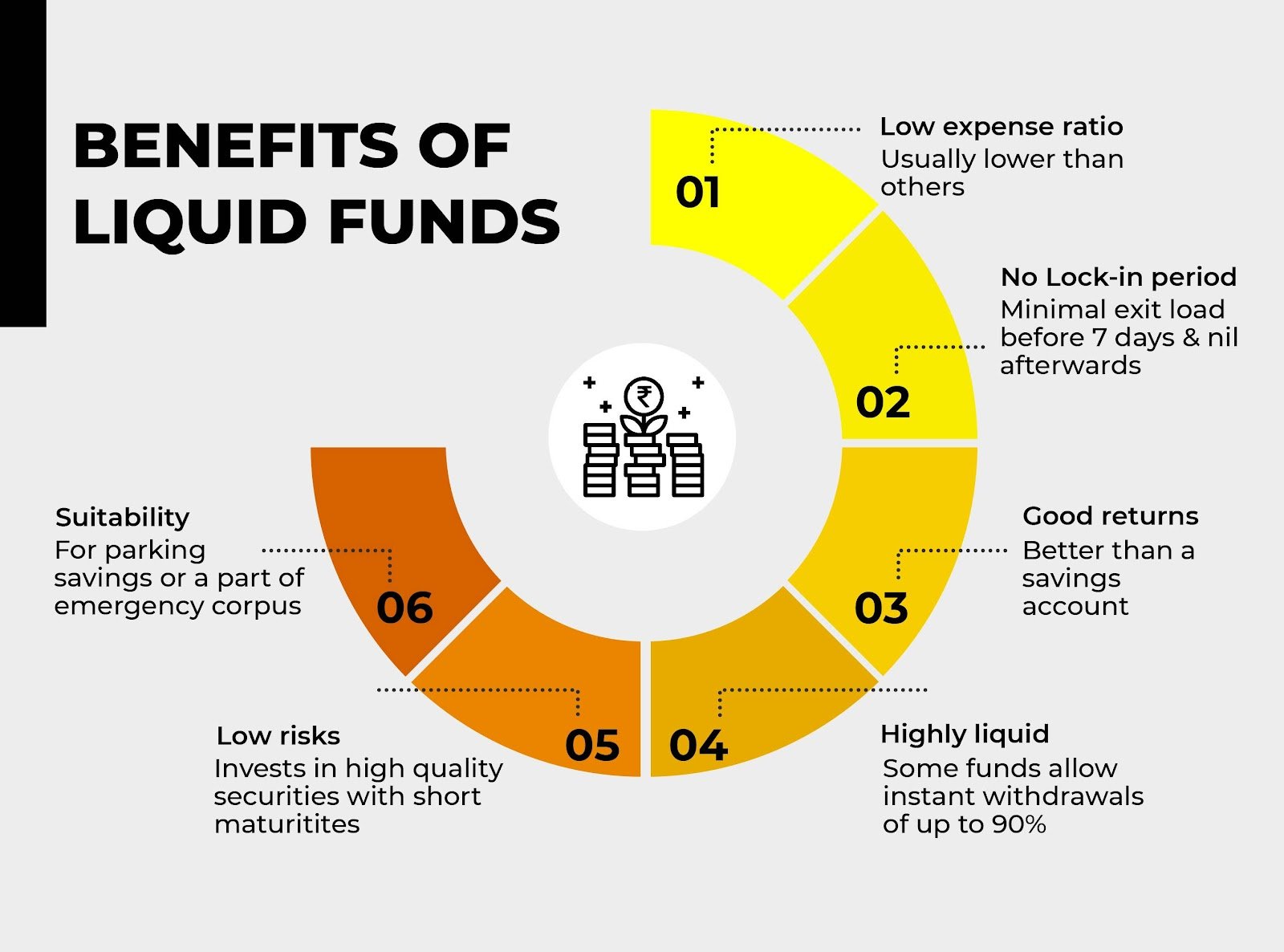

Advantages of Money Market Funds

Money market funds compete against similar investment options, such as bank money market accounts, ultrashort bond funds, and enhanced cash funds. These investment options may invest in a wider variety of assets, as well as aiming for higher returns.

The primary purpose of a money market fund is to provide investors a safe avenue for investing in secure and highly liquid, cash-equivalent, debt-based assets using smaller investment amounts. In the realm of mutual-fund-like investments, money market funds are characterized as a low-risk, low-return investment.

Many investors prefer to park substantial amounts of cash in such funds for the short-term. However, money market funds are not suitable for long term investment goals, like retirement planning. This is because they don’t offer much capital appreciation.

Money market funds appear attractive to investors as they come with no loads—no entry charges or exit charges. Many funds also provide investors with tax-advantaged gains by investing in municipal securities that are tax-exempt at the federal tax level (and in some instances at the state level, too).