What is a Money Back Policy?

As the name suggests, a money-back policy is a policy which gives money-back at regular intervals. This money-back is paid during the plan tenure and is a percentage of the Sum Assured. Money-back pay-outs are called Survival Benefits. These benefits are paid during the plan tenure and on maturity, the remaining Sum Assured is paid along with vested bonuses. However, if the insured dies during the plan tenure, the full Sum Assured is paid irrespective of the Survival Benefits already paid.

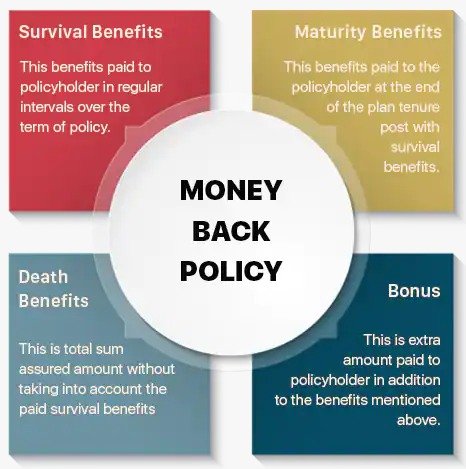

Benefits of a Money Back Policy

The Money Back policy provides various benefits like death benefit, maturity benefit and survival benefit along with bonus which is paid in addition to the sum assured. This bonus from the insurance company is based on its performance. It is vital to take a look at various components that make up a life insurance policy.

Survival Benefits

Money is paid to the policy holder every few years over the lifetime of the policy. The payment gets started after some years of the start of the policy and continues until maturity. For Example: Rohan has opted for a Money Back Life Insurance policy and has a plan with a sum assured of Rs. 5 lakhs for a term of 20 years. He would need to pay a premium for 20 years and get back a part of sum assured at regular intervals. He would get 15% of sum assured after 5th, 10th and 15th year of the policy. Which is 15 X 3 = 45% of the Sum Assured as Survival Benefit. Also, on maturity, he would get the remaining 55% of the sum assured and bonus if any.

(Note: The numbers in the above example are for representational purpose only. Actual term of years, sum assured and % may vary in reality.)

Death Benefits

The nominee of the policy gets the death benefit of the insured person. This benefit includes sum assured of the money back policy and bonus accumulated on the policy. But, this does not include the survival benefit as they are only given to the insured when they are alive. For Example: Mr. A passes away in the 17th year after taking the policy. In that case, the nominee will receive the sum assured and bonus that would have been accrued over the past 17 years since it was taken. The remaining survival benefits will not be paid.

Maturity Benefit

This benefit is received by the insured person on the maturity of the money back plan and includes three components:

- Sum Assured: This is the total cover that is chosen by the insured at the start of the policy.

- The Bonus: This includes the accrued reversionary bonuses declared by the insurer. The latter mostly depends on the performance of the company.